National

PM: Shift on Global Taxes Should Bring Changes

NASSAU, BAHAMAS – The Bahamas was among 125 United Nations member states supporting a resolution shifting the decision-making on global tax policies and rules away from large global bodies.

-

Court2 days ago

Court2 days agoTwo Men Arraigned for Death of American Woman

-

National5 hours ago

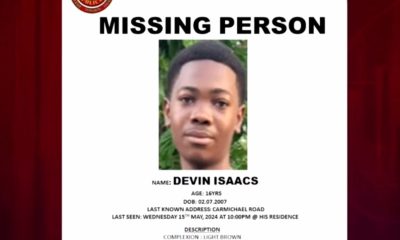

National5 hours agoDevin Isaacs’ Mom: I’ve Stopped Counting The Days

-

National5 hours ago

National5 hours agoWhat Is The Chef de Mission and What Do They Do?

-

Court2 days ago

Court2 days agoPanel Upholds Drug Conviction and Sentence

-

National2 days ago

National2 days agoUtopia of The Seas Brings Opportunities for Bahamians

-

National2 days ago

National2 days agoExuma Cays: There’s Something Out Here for Everybody

-

National1 day ago

National1 day agoDespite Promised Savings, High Costs Remain A Concern

-

National2 days ago

National2 days agoForeign Minister: Will Political Rhetoric Translate Into Policy?